Looking for a safe way to boost your savings in 2024? The debate around high-yield savings accounts (HYSA) versus Treasury bills (T-Bills) has never felt more urgent. Both options attract savers who want security and strong returns without the stress of wild market swings. So which one actually offers the safest, highest return with the fewest headaches? This in-depth guide breaks down exactly what you need to know to make the right choice.

Am I Missing Something? Why T-Bills Are Suddenly Everywhere

Suddenly, T-Bills are everywhere you turn. Headlines, financial podcasts, even friends who never used to talk about investing are putting cash into T-Bills instead of HYSAs. What changed?

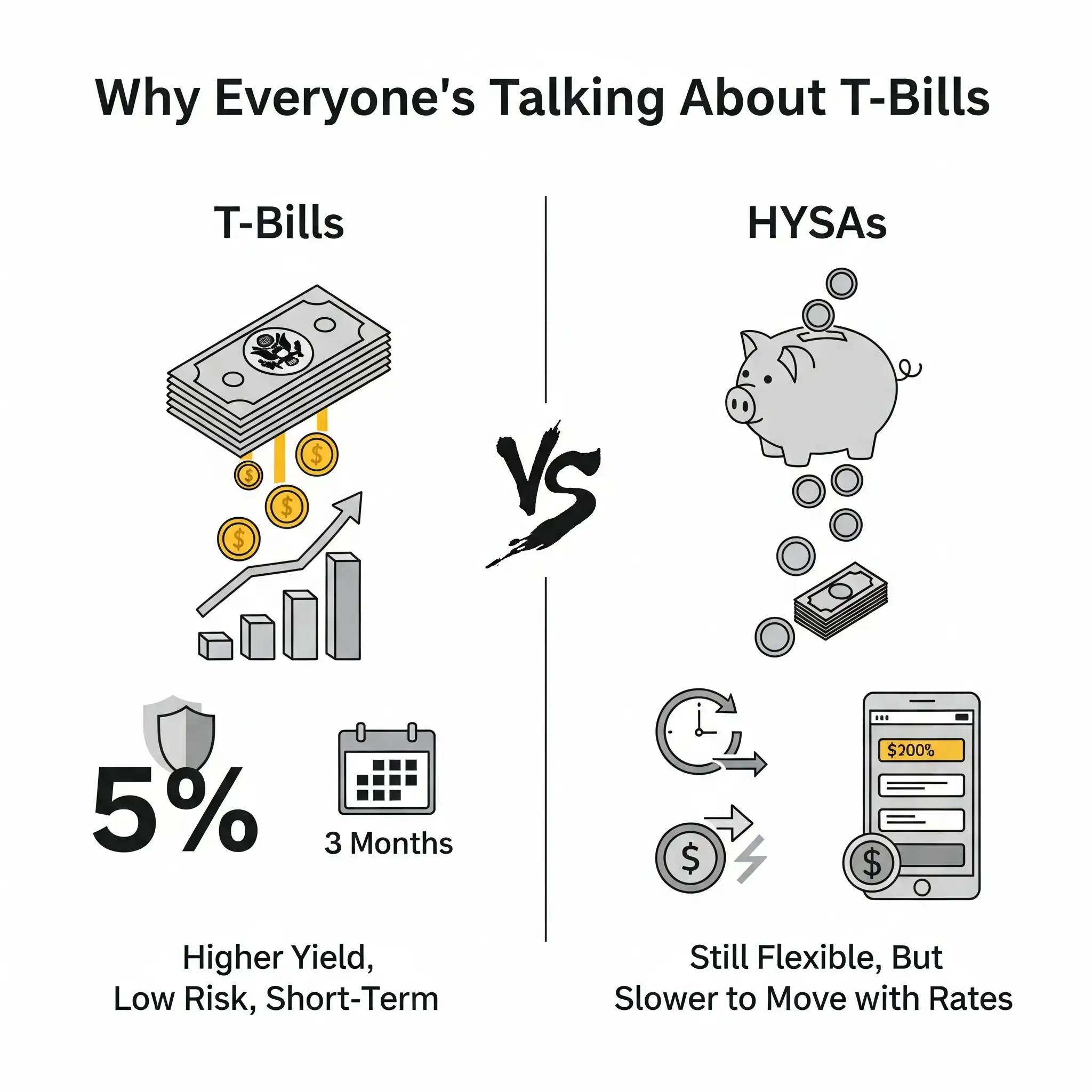

The answer lies in how interest rates have shot up over the past two years. When rates were close to zero, HYSAs and T-Bills both paid out pennies. Now, the federal government—through T-Bills—offers yields that compete with, or even surpass, what direct-bank HYSAs can give.

You might remember when earning more than 0.5% sounded impossible. Today, annualized rates above 5% are common for both. As banks lag behind the federal funds rate, T-Bills have drawn attention for anyone looking to do better than their old savings account.

The Simple Answer: How High-Interest Rates Changed the Game

When rates stay low, cash savings grow slowly. People left their money in HYSAs for flexibility, ignoring T-Bills as they returned little more than checking accounts.

Now, with short-term rates climbing, T-Bills stand out. Suddenly, a three-month T-Bill pays real money, outpacing some online banks. Investors and regular savers are weighing HYSAs vs. T-Bills because the math is different—returns keep rising with each rate hike.

HYSAs still offer competitive annual percentage yields (APYs), but banks often move slower to reflect higher federal rates. Meanwhile, T-Bills, sold directly by the U.S. Treasury, reset every auction day. This makes them an attractive, government-backed way to get a better rate for your cash.

The Core Difference: Instant Access (HYSA) vs. Government-Backed Yield (T-Bills)

A HYSA is a savings account at a bank or credit union. You can deposit and withdraw cash whenever you want, and funds are protected up to $250,000 by FDIC or NCUA insurance.

T-Bills, on the other hand, are short-term U.S. government debt securities. You hand over your money, and in return, you receive a lump sum at maturity—with interest baked in. T-Bills have set terms (usually four, eight, 13, 26, or 52 weeks). You can’t get your cash out before maturity unless you sell them in the secondary market, which may not always be practical or profitable for short durations.

That means the true debate is simple: do you want instant access or a slightly higher, government-guaranteed return in exchange for locking up your funds for a few months?

Solving the #1 Pain Point: Is Buying T-Bills a Huge Hassle?

If just hearing “Treasury Bills” makes your eyes glaze over, you aren’t alone. Many assume that owning T-Bills requires endless paperwork, long waits, or tech headaches. The good news: it’s less complicated than you think.

The TreasuryDirect Problem: Why the ‘Official’ Website Feels Stuck in 1998

TreasuryDirect is where you buy T-Bills straight from Uncle Sam. It’s official, but not exactly user-friendly. Think slow pages, clunky forms, and a layout that hasn’t changed in decades.

You’ll need to create an account, which includes identity checks. Sometimes, the site requires you to unlock your account by mail if anything goes wrong. Navigation confuses plenty of people, and the interface often feels outdated compared to modern banking apps.

Still, the payoff is access to the freshest auction rates and no broker markups. If you can push through the tedium, TreasuryDirect does the job (just be prepared for old-school quirks).

The Easy Way: A Step-by-Step Guide to Buying T-Bills on Fidelity or Schwab

Big brokerages like Fidelity and Charles Schwab have changed the game for buying T-Bills. The process is clear and fast. Here’s how to do it:

- Open a free brokerage account if you don’t already have one.

- Log in and select the “Trade” or “Fixed Income” tab.

- Search for U.S. Treasury Bills. Filter by maturity—you’ll see current rates and terms.

- Enter the amount you want and place your order for the next available auction or select a T-Bill on the secondary market.

- Confirm details, submit, and you’re done.

Once purchased, T-Bills are held in your brokerage account, and proceeds go straight back into your cash balance when they mature. Brokerages have simple dashboards to track your holdings, so you avoid most headaches found with TreasuryDirect.

Answering Your Top Questions on Liquidity, Safety, and Taxes

People comparing HYSA vs. T-Bills care most about three things: access to their money (liquidity), keeping it safe, and how much goes to taxes.

What if I need my money back early?

- HYSA: Instant access. Withdraw cash whenever you want, often without penalty.

- T-Bills: Locked until maturity (from 4 to 52 weeks). If you want out early, you must sell on the secondary market through your brokerage. Prices can change, so you may get slightly less than you put in.

Bottom line: For a traditional emergency fund, HYSAs win on flexibility.

Is my money safer than in a bank?

- HYSA: Covered by FDIC or NCUA insurance up to $250,000 per depositor, per bank.

- T-Bills: Backed by the full faith and credit of the U.S. government—widely considered the world’s safest borrower. You own the T-Bill directly, not through a bank, so bank troubles don’t affect your investment.

Both options present extremely low risk for the average saver.

How much do I really save on taxes?

- HYSA: Interest is taxed as ordinary income on both federal and state returns.

- T-Bills: Interest is taxed at the federal level, but not at the state or local level.

For high earners in states with steep taxes, T-Bills can put extra money in your pocket at tax time. If your state income tax is low or zero, this difference isn’t as dramatic.

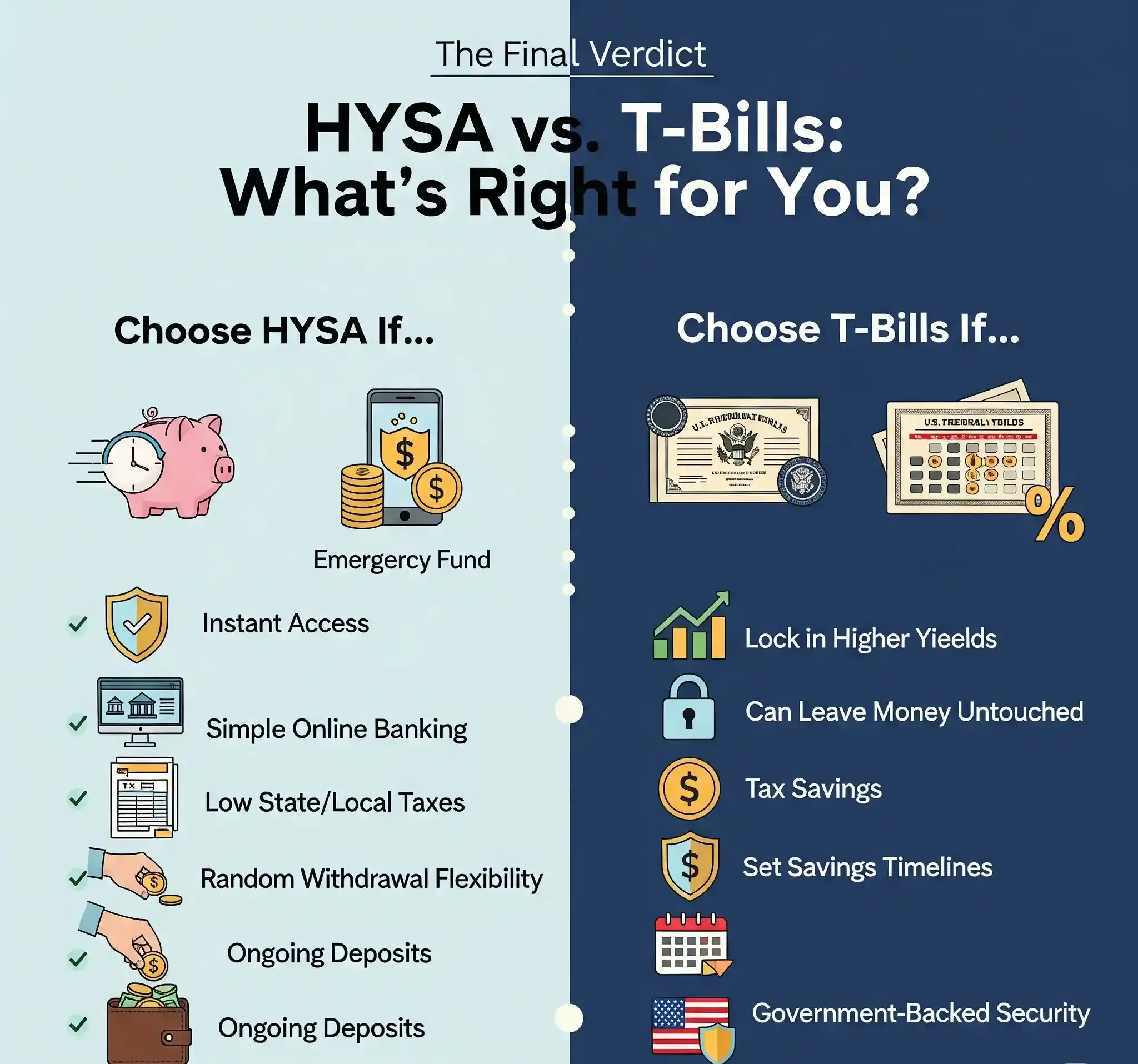

The Final Verdict: A Checklist to Choose What’s Right for You

Still unsure in the HYSA vs. T-Bills debate? Use this checklist to help you decide.

Choose a HYSA if…

- You value instant access for emergencies.

- You want a simple, familiar online banking interface.

- Your state/local taxes are already low, so the T-Bill tax break is less relevant.

- You may need your savings at random times.

- You like seeing your balance grow with regular deposits.

Choose T-Bills if…

- You want to lock in higher yields without bank risk.

- You can leave your money untouched for 4-52 weeks.

- You’re looking to reduce your state or local tax bill.

- You’re saving for a purchase with a set timeline.

- You favor government-backed security and like watching maturity dates.

FAQs

Can I lose money with T-Bills?

If you hold to maturity, you receive your full principal plus interest. Selling early on the secondary market can lead to a small loss if market rates shift.

Are HYSAs “safe” if my bank fails?

Yes, up to $250,000 per bank, per depositor, with FDIC or NCUA insurance.

Is there a minimum investment for T-Bills?

Yes, usually $100, but brokerages may have their own minimums.

How fast can I move money between HYSA and T-Bills?

Transfers between accounts can take 1-3 business days, due to ACH transfer times.

Do I have to report T-Bill interest at tax time?

Yes, you’ll receive a 1099-INT for T-Bill interest—just as you would for HYSA interest.

What if rates drop after I buy a T-Bill?

You’ve locked in your yield until maturity, making this a safe bet if you like your current rate.

Conclusion

Choosing between HYSA vs. T-Bills isn’t about finding a perfect winner. It’s about matching your needs—do you want maximum access, rock-solid safety, or the top return for your state’s tax laws? Both are pillars of a smart savings strategy in 2024. Know your goals, weigh the trade-offs, and put your cash to work with confidence.

Hello! I’m Ibrahim, the owner and writer of this blog. I run a chicken farm with 160 chickens, and I’ve gained a lot of knowledge about raising and caring for them. Now, I want to share my insights and experiences with you to help you in chicken keeping.