Late last year, I hit a rough patch. Like many others, I watched some of my top holdings nosedive during a sharp downturn. But that moment flipped a switch for me. I realized my approach to investing needed to evolve with the future of finance — not just survive it. So, I rebuilt my portfolio based on a smarter strategy, cleaner data, and clearer goals.

Let’s unpack how you can do the same — one simple step at a time.

Setting Clear Financial Goals

Strong investing starts with goals. Think about what really matters to you. Do you want to buy a house, retire early, or pay for your kids’ education? In 2025, with choices changing quickly, clear goals help you stay on track.

Start by writing down your biggest dreams and what you’ll need to get there. Break them into short-term (one to five years) and long-term (ten years or more) buckets. Use a simple table or a notepad app on your phone. Make your goals specific and put a dollar amount next to each one.

- Short-term: Emergency fund, vacation, car purchase

- Long-term: Retirement, college funds, real estate

Update your plans once a year or when life changes. Goals are your compass, keeping you pointed in the right direction.

Building a Resilient Investment Strategy

You don’t need to be a financial wizard to make smart moves. The key is to spread your money across different types of investments. This simple step—called diversification—helps protect you if one area drops.

Split your money between:

- Stocks (for growth)

- Bonds (for balance)

- Real estate (for steady income)

- Cash (for flexibility)

- New options like digital currencies (for extra potential, but only with money you can afford to risk)

Check your mix every six months. If your stocks grow faster than other parts, you might need to rebalance. This way, you avoid having too many eggs in one basket. With regular attention, you stay ready for surprises.

Investing in a Changing Market Environment

2025 brings new trends few could imagine a decade ago. Digital currencies are mainstream. Investments that help the planet (called ESG) draw record interest. Global events move markets faster than ever.

Adapt by:

- Keeping some money in up-and-coming areas like clean energy or blockchain

- Reading news from trusted sources, but not chasing hype

- Preparing for both quick swings and long-term growth

If the old rules don’t fit anymore, it’s okay to learn new ones. The future of finance rewards those who watch, learn, and adjust.

Managing Volatility and Uncertainty

If your heart races when markets drop, you’re not alone. Ups and downs are part of the ride. The secret is knowing what you can control.

During tough times:

- Keep enough cash so you don’t need to sell in a panic

- Check your risk level against your age and needs

- Turn off breaking news alerts if they make you anxious

Most smart investors ignore short-term noise and stick to their plan. Markets recover in time, and patience often pays.

The Truth About Fluctuations and Losses

Markets will always correct. That doesn’t mean it’s time to jump ship. Your best weapon? A calm, data-informed mind.

Systematic risk — like inflation, war, or recession — can’t be avoided. But with smart allocation and diversification, your portfolio becomes more resistant to losses.

Why Diversification Wins

Diversify across asset classes like equities, bonds, real estate, and cash. Think of it as an automatic protection mechanism against the bankruptcy of any individual stock or security.

Investor Psychology & Decision-Making

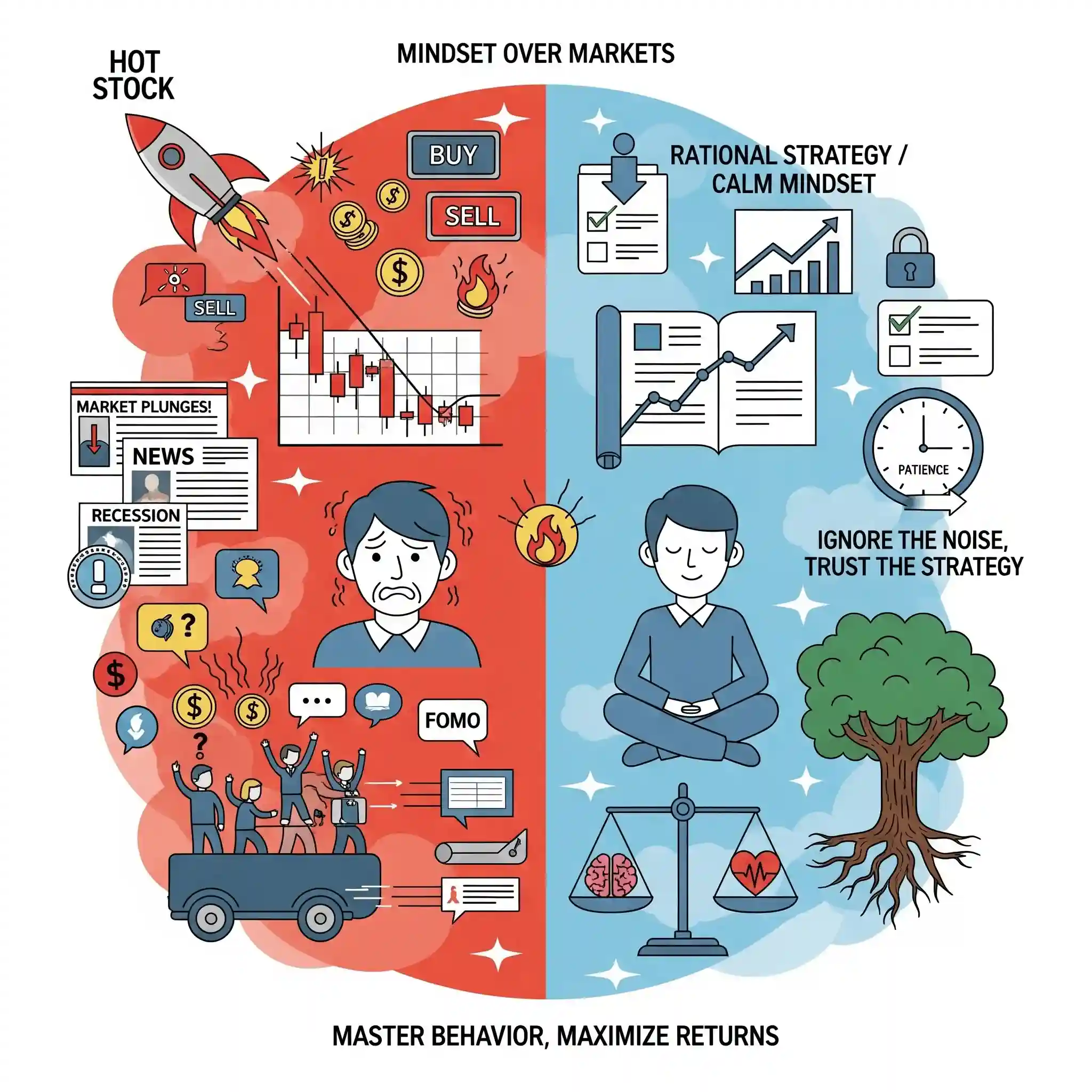

Mindset Over Markets

This is the age of psychology meets money. Your behavior, not just your assets, drives your performance.

Success comes from controlling impulses, sticking to your plan, and avoiding distractions.

A dose of emotional intelligence goes a long way in money management.

Avoiding the Hype Trap

Don’t chase winners or dump losers without logic. Many high-flying stocks have historically underperformed indices in the long haul.

The solution? Follow your strategy, ignore the noise.

Liquidity, Interest Rates, and Regulation

2025 brings a patchwork of new finance rules. Digital assets face tighter controls. Central banks adjust interest rates to guide the economy. Your money choices can change overnight.

Pay attention to big moves:

- New laws about digital wallets, taxes, or reporting

- Interest rates that rise or fall, affecting loans and safe investments

Remember, your mind plays tricks in stressful times. Don’t let headlines push you into bad trades. Wise investors pause, reflect, and stick to their rules.

Modern Investing Tools for 2025

You don’t need a Wall Street office to invest well. In 2025, helpful apps put powerful tools in your pocket. Robo-advisors build portfolios for you using smart math. AI tools study the market and offer real-time alerts.

Look for apps that:

- Show all your accounts in one place

- Suggest moves based on your goals

- Offer clear fees and strong security

Tech makes investing simple enough for everyone. With a few taps, you can run your own financial playbook. You don’t need to be a math whiz—the best tools handle the math for you.

Cryptocurrencies & Blockchain

No “future of finance” guide is complete without cryptocurrencies. Still volatile? Yes. But the underlying blockchain technology is disrupting everything from payments to funding.

While regulation still evolves, digital assets and tokens are gaining stable ground in diversified portfolios.

AI, Forecasting & Automated Investing

The future is data-first. Artificial intelligence now handles forecasting, valuation, and even portfolio optimization.

Modern advisors — many powered by fintech — personalize investing like never before. You can analyze your account, set thresholds, and even get suggestions to reconfigure based on allocation best practices.

A Household Guide to Wealth Building

Everyday Habits that Lead to Success

Wealth is built in the small moments, not just the big ones. Start with these simple steps:

- Budget as a family: Talk openly about money goals

- Save automatically: Set up your bank to move money to savings and investments every payday

- Learn together: Pick one new money topic each month and discuss how it affects you

Join forces with your partner or children. When everyone knows the plan, you work toward future dreams together.

From Cash Flow to Growth Metrics

Budgeting isn’t optional. It’s the backbone. Know your monthly income, savings contribution, and debt withdrawal patterns.

Track your expenses and plan your retirement with thoughtful monitoring and periodic assessment.

Benefits of Consulting Experts

Whether you’re building steady returns or navigating taxes, expert consulting helps. Look for professionals who understand economic dynamics, performance analytics, and strategy execution.

Plain talk, clear scenarios, and no-fluff feedback — that’s what real financial planning should feel like.

The Future Has Arrived — Are You Ready?

Picture a life where you don’t worry about bills. Your money grows while you sleep, opening doors to choices you’ve only imagined.

Start with one small step today:

- Set your first financial goal

- Download a finance app

- Schedule a family money talk this weekend

The future of finance is yours to shape. Take action now and build the independence you deserve.

Final Thoughts

- Know your goals and align your investments accordingly.

- Embrace diversification, resist emotional decisions.

- Adopt new technologies without abandoning timeless principles.

- Use modern tools to monitor performance and protect your returns.

- Keep an eye on trends, but never stray from your long-term plan.

Your 2025 Investor’s Guide should reflect who you are, not what the markets whisper.

Stay grounded. Stay informed. And always remember – in money and in life, behavior beats brilliance.

FAQs: The Future of Finance in 2025

How should I start investing if I feel overwhelmed by all the options?

Start small with what you understand. Pick a low-cost index fund or a well-reviewed robo-advisor. Continue to learn, and add more choices as you grow confident.

Is it too late to learn about digital currencies and new tech?

No. You can learn at any age. Many guides and courses explain digital assets in plain language. Invest a small amount to test and learn.

What happens if the market crashes again?

Stay calm and avoid gut reactions. Keep some cash on the side and remember your long-term plan. Panic selling locks in losses, while patience often allows for recovery.

Do I need a financial advisor in 2025?

You don’t need one to start. Many tools can guide you. But if your finances get complex or you want a second opinion, a good advisor can help.

How can I protect my family from financial surprises?

Build an emergency fund, teach everyone good money habits, and avoid spending more than you earn. Regular check-ins help you spot problems before they grow.

Hello! I’m Ibrahim, the owner and writer of this blog. I run a chicken farm with 160 chickens, and I’ve gained a lot of knowledge about raising and caring for them. Now, I want to share my insights and experiences with you to help you in chicken keeping.