I was 19 and chasing luxuries. I booked travel, bought clothes, and told myself I was still saving because the trend felt normal.

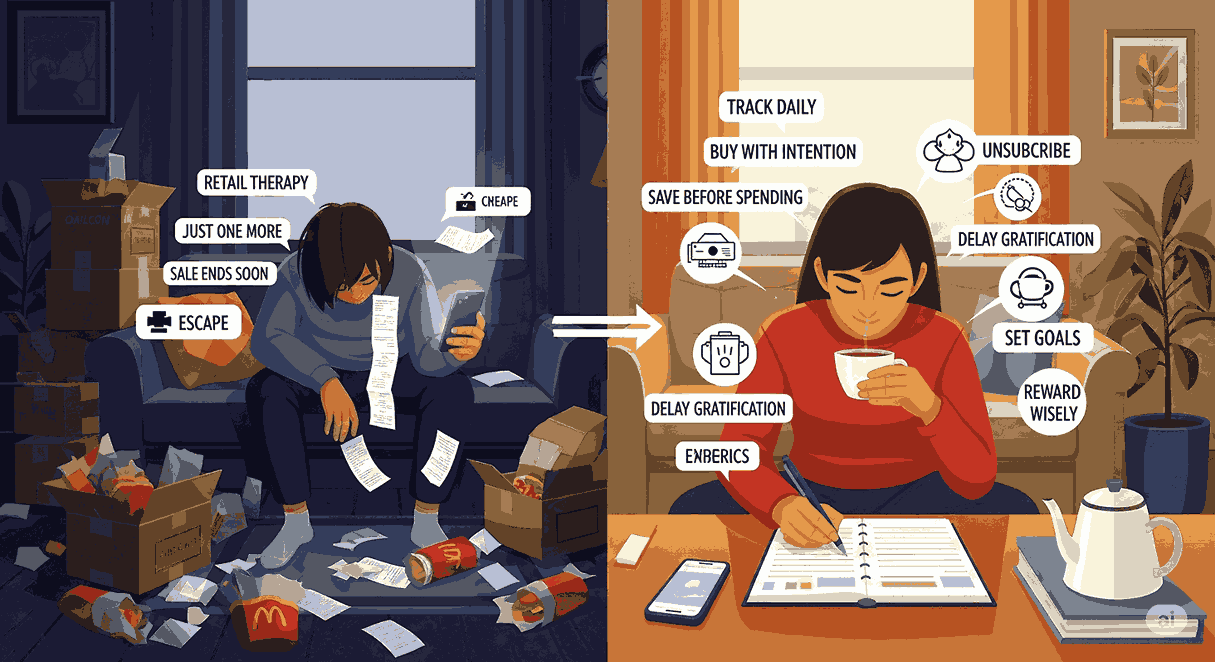

Then I slipped into doom spending. Social media showed every perfect person and shiny shops. I used buying to self-soothe when I felt pessimistic about the economy and my future.

I saw Psychology Today explain how this practice can be unhealthy and even fatal. A lecturer in finance and a banker warned me that staying chronically online, soaking up bad news, can feel like Armageddon. Those heavy feelings turn into habits.

Many are concerned about the state of things. Every survey shows more stress. The phenomenon is linked to inflation and uncertainty. I used to rationalize: it’s my money, food costs are expensive, I can spend carelessly because I earn it. I rushed to buy a house before some new program or government rule. I tried to invest in real estate fast, before another change. If a deal was available, I would pay, and the circle kept turning.

My generation fears becoming poorer adults. We want to feel financially safe. We crave security, but the illusion of control can fool us. I chose a new mindset. I’m an engineer, so I tested tiny steps. I named my dissatisfaction, eased peer pressure, and planned an escape plan that starts with slow breathing.

Understanding Doom Spending (And Why It’s So Hard to Stop)

I learned that doom spending grows with debt, easy credit, slick budgeting apps, and messy finances. We hunt for fast yield on savings and chase new products and technology, plus “I deserve it” drinks.

I ran an analysis on a housing website. Property prices rose. More properties were listed. The cost scared me. My happiness dipped. My relationship with buying changed when I grew my understanding of attachment from childhood. With knowledge, I did an evaluation. I wasn’t broken—just insecure, a bit avoidant, with learned behavior and attitudes from my upbringing and weak money literacy.

Spending is a transaction with a visceral pull. An impulse hits, and we make fast purchases. Notifications ping. One-tap authorization speeds the decision. Smooth banking and cash‑like swipes make seamless payment through Apple or Google feel easy. Less emotion in the process. No handing over bills. Less pain.

I built a simple budget, new debt rules, and clear strategies. They proved successful. I hunt for a discount, especially for back-to-school months. I guard my finances, plan my future, and keep alternatives ready for hard days.

Spotting the Signs You’re Stuck in the Doom Spending Loop

- You’re a Gen Z hire in the gloomy workforce after the pandemic. You carry student debt, face inflation, and see housing prices jump.

- You go into debt spending after impulsively buying stuff you can’t afford. It feels like coping with anxiety. The short-term emotional lift becomes a long-term financial issue.

- You hold a poor outlook on the planet and pause saving. You lose sight of goals, delay retiring, and put off purchasing a home. You try to live in the moment, feel hesitant about planning retirement and prosperity.

- You try retail therapy. Many Americans do. You buy unneeded things to escape stress. The gratification fades. Healthier ways to cope work better.

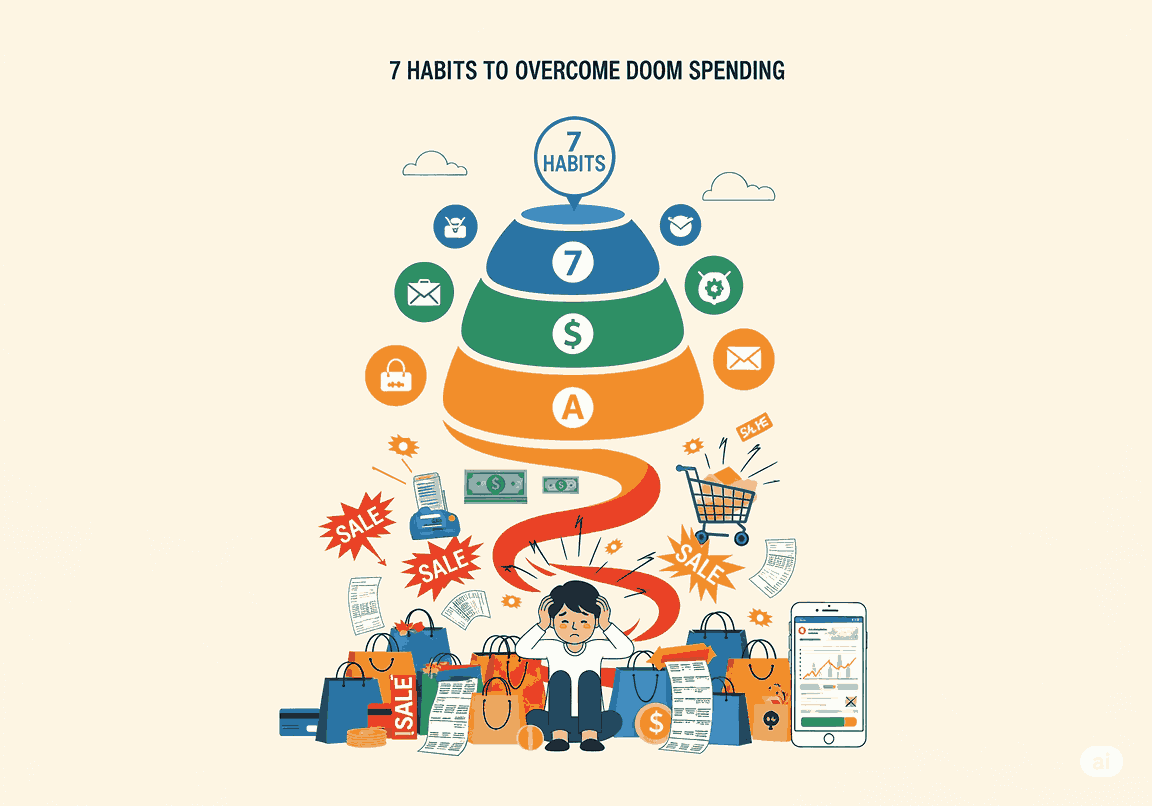

7 Simple Habits to Break the Doom Spending Cycle for Good

Habit 1 – Create a “Pause & Reflect” Rule Before Every Purchase

I pause for 30 seconds and breathe. I ask, do I need this now? Can I wait a day? What am I feeling?

This helps consumers slow down a purchase and see the impact. It breaks the cycle and beats barriers that retailers and slick payment methods hide.

I add friction. Fewer clicks from a laptop or phone to the store reader. I pull my credit card out each time. I block saved information online, use cash for in-store, and keep my wallet in my bag. I cut discretionary buys like new sneakers. I mute Instagram, stop doomscrolling news websites, and current events content. I switch topics, unplug, go exercising, call friends, or walk in the park. I mute influencers selling flashy lifestyles.

Habit 2 – Build a Guilt-Free Fun Budget You Actually Stick To

I list income, bills, and debt. I set a small, fun pot that fits my plan. I ignore pushy algorithms. I pick a strong mindset, a positive tone, and save space for financial self-care when stressors hit. That keeps me secure, witha steady footing, and lower anxiety levels.

I track savings from each income check. I fund retirement, tiny investments, and savings first. I cheer progress and small milestones. I tie treats to my exercise program.

This helps my relationship and financial security, too. We review results monthly. We list each trade-off. Which objects in my cart matter? I trim discretionary spending by 10% to shock my system in a good way. I stop treating every bad occurrence with a treat. It clears the gloom.

Habit 3 – Unfollow Digital Temptations and Ads

I mute goods and services ads. I remember the pandemic-induced recession and rising consumer prices. My expenses grew. My consumption drifted toward loud lifestyles.

Now I’m restricting spending. I shop with a list. I replaced late scrolls with books. I add to savings, pay debt, and buy only necessities.

My millennials circle wants wealth. We’re investing in the stock market. Real financial success needs steady steps to retirement.

Habit 4 – Start a “Joy‑per‑Dollar” Tracker to Rethink Value

I run a simple poll on each buy. I log challenges that sparked impulsive purchases. I name the anxiety, hopelessness, panic buying, price hikes, or shortages. I spot when I felt susceptible to social media, pushy tariffs headlines, flashy shopping apps, wholesalers, and trending videos.

Then I tally the financial toll. I see how consumers with credit cards stack a debt balance. I do more analysis, read a study, and check research on the reasons we spend. I build better rules that cover basic needs first.

I ask which adults in my generation are participating. What am I considering? What is difficult? Which habit can I change with ease? I name my feelings, fear, and outside influences that keep fueling purchases. I note what was advertised, the average reported cost, and the rise. I track my effort and what I’m committing to. I look for common traps. I’m embracing the challenge. I set small markers of success each month.

I track the proportion and number of buys I regret. I watch repayments, obligations, and each payment. I plan for higher market swings and slow down holiday purchases.

Habit 5 – Swap Retail Therapy for Mood‑Boosting Alternatives

A trend in doom spending rises when we need coping for pessimism about the economy, politics, or personal finances. For millennials, consumers, and even the wealthy across generations, consumer sentiment shifts. One survey shows an optimistic quarter. Another shows baby boomers with more willingness to splurge than younger shoppers. In a few months, the swing can flip for many reasons across generations.

To beat financial defeatism, I track milestones in saving and block impulse purchases on social media. I avoid frictionless checkout. I match intentions to cash. I split buys into discretionary and nondiscretionary categories. I stay cautious with dining, apparel, beauty products, jewelry, and splashy experiences, even the travel-related ones.

I ask about the value after the purchase. Will it have real cultural cachet, or just a short buzz? I built a small project for businesses I advise. We invest in analytics and generative AI. We watch competitor baskets with smart tools, study behavior, and run predictive checks on spending spikes. We flag indulgence bursts and test optimism across a variety of signals. We track money and attitudes, map the trend in risky habits, and shift the mindset away from doom spending.

Habit 6 – Automate Savings Before You Can Spend It

I auto‑move cash into savings on payday. I treat it like rent. I use split‑deposit banking and hunt for savings products with better yield.

I also added checkout friction. I turn off one‑tap. I require authorization. I block saved cards. I only use Apple or Google wallets when it’s not too fast. I pay with cash when I can. Feeling the handing over gives helpful pain.

I also invest small sums in index funds and later in real estate. I watch property prices, read website analysis, and track properties listed. I pay myself first and stop the circle.

Habit 7 – Get Accountability From a Friend (Or a Money Buddy)

I asked a buddy to be my “no‑buy” coach. We text before big buys. We cheer wins. A lecturer in finance, a banker, and an engineer friend helped me set guardrails.

We share strategies for consumers. We reduce the impact of the cycle. We spot barriers that retailers and fast payment methods use. We list traps: late clicks, laptop taps, phone swipes, the store reader beep, a credit card dip, saved information online, “free” cash‑back in-store, and a ready wallet.

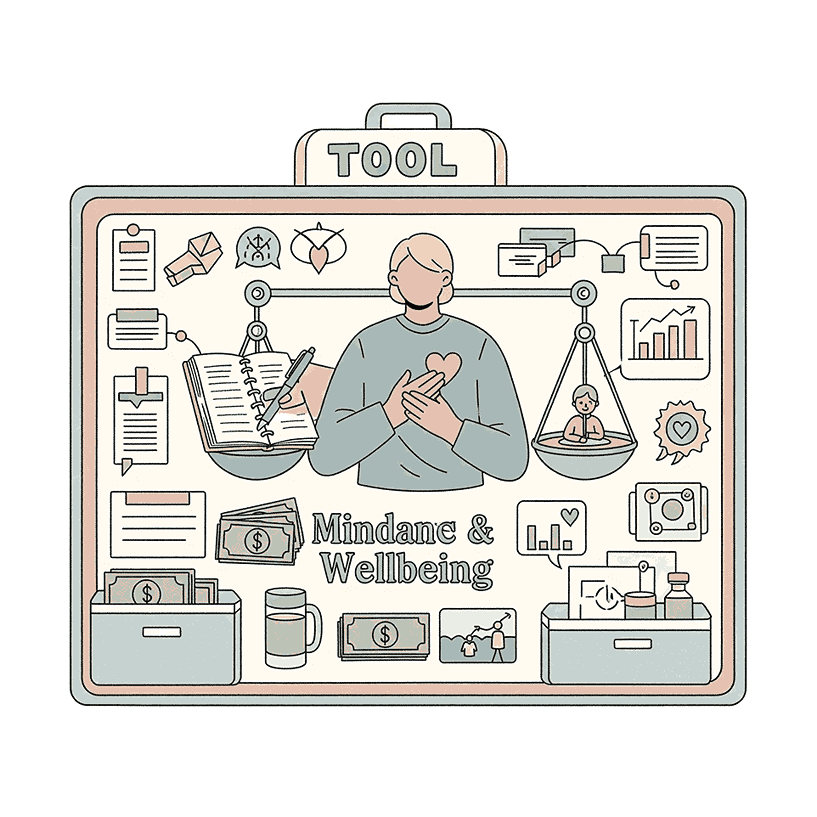

Tools and Resources to Help You Stay on Track

- Planner: a simple budget, clear budgeting, and a weekly budget plan for income, expenses, and savings.

- Mind: add emotional awareness, stress management, meditation, sports, hobbies, and daily exercise to protect physical health.

- People: join support groups, boost self-awareness, and use motivation boards and tiny challenges.

- Pros: financial counseling for tailored guidance, fresh strategies, and tight goals that reshape spending habits for a secure future.

- Tech: block one‑tap, add authorization, silence notifications, and slow transaction speed in shopping apps.

- Time: better time management and weekly planning. Use needs recognition and conscious spending to match buys to values.

- Care: ask for emotional support from therapists when stress spikes. Build stability with small, healthy habits.

When to Seek Professional Help for Money Management

Watch for a syndrome of excessive spending and harmful behavior in individuals, sparked by adverse economic conditions or negative events in personal life or social life. In uncertain times and stressful periods, or after mood changes from economic uncertainty, people overspend to feel control and quick happiness. But short-term satisfaction and temporary relief can lead to financial distress and lower quality of life. The consequences include more stress and anxiety. The loop can become a secure but false vicious circle, hurting emotional health, financial health, and long-term sustainability.

Think about root causes: global crises, high unemployment rates, market fluctuations, and future anxiety. Many use it as a coping mechanism to numb emotional emptiness. It shifts consumption habits and lifestyle. Comparison feeds inadequacy and unnecessary spending. During pandemics and crisis periods like COVID-19, social isolation made it worse.

Seek help if you see financial difficulties, a broken budget, rising debt, or financial instability. Watch for mental health issues like depression. Note the hit to relationships, more disagreements, tension, and weak communication. If you feel insecurity, low personal fulfillment, or loneliness, build social connections.

Build a new plan: tight budgeting, a clear budget plan, track income, expenses, and savings. Add emotional awareness and stress management. Try meditation, sports, hobbies, and exercise for physical health. Join support groups. Grow self-awareness and motivation with small challenges. Get financial counseling and steady guidance. Use fresh strategies and smart goals to rebuild spending habits for a secure future.

If you face a bad economic situation, pick an escape mechanism that heals: mindful shopping, simple relaxation, and community. Weigh the societal impact during economic crises and aim for financial sustainability. Keep questioning impulsive shopping. Practice time management, steady planning, and strong needs recognition. Try conscious spending. Ask for emotional support from therapists. Seek stability and daily healthy habits.

Final Thoughts

I still stumble, but I catch myself. I breathe, pause, and choose with care. I buy less and value people more.

I also watch policy and prices. I look at jobs, rates, and tariffs. I shop small. I vote with my cart and voice.

With steady steps, doom spending fades. Small wins stack into change.

FAQs

What causes doom spending in the first place?

Doom spending is often caused by stress, fear about the future, constant bad news, and wanting short-term comfort instead of saving, especially during uncertain economic times or personal hardships.

Is doom spending the same as “gloom spending” or panic buying?

They’re similar but not identical. Doom spending is ongoing emotional overspending, gloom spending is buying to cope with sadness, while panic buying is rushed stockpiling during crises.

Can I stop doom spending without a strict budget?

Yes. Setting spending limits, removing shopping triggers, automating savings, and tracking joy from purchases can help without a rigid budget plan.

What does doom spending mean?

Doom spending is spending money, often on non-essentials, because of a negative outlook on the economy, future, or personal life—seeking comfort despite the financial harm.

Is Gen Z doom spending?

Yes. Surveys show many Gen Zers spend on travel, clothes, and dining despite economic worries, influenced heavily by social media and peer pressure.

What are people doom buying?

Common doom purchases include electronics, luxury items, travel, dining out, clothes, beauty products, and home goods—things that offer quick happiness but hurt long-term savings.

How to avoid doom spending?

Pause before purchases, unfollow shopping ads, set joy-per-dollar goals, choose free activities, and automate savings so money is harder to access for impulse buys.

Is cash stuffing or envelope budgeting better for impulse buys?

Both help, but envelope budgeting works best—once the cash in a category is gone, you can’t overspend.

How do I handle doom spending with a partner or family member?

Be honest about finances, set shared goals, track spending together, and replace shopping with fun free activities to build healthier habits as a team.

Sources, Studies, and References

- Federal Reserve Bank of New York – Household Debt and Credit: https://www.newyorkfed.org/microeconomics/hhdc

- Consumer Financial Protection Bureau – Credit Card Market Report: https://www.consumerfinance.gov/data-research/research-reports/

- U.S. Bureau of Labor Statistics – CPI Detailed Reports: https://www.bls.gov/cpi/

- University of Michigan – Surveys of Consumers: https://data.sca.isr.umich.edu/

- National Retail Federation – Back-to-School Spending: https://nrf.com/topics/back-to-school

- American Psychological Association – Stress in America: https://www.apa.org/news/press/releases/stress

- Pew Research Center – U.S. social media use: https://www.pewresearch.org/internet/

- Adobe Digital Insights – Online shopping trends: https://business.adobe.com/resources/reports.html

Note: Check your local market and city data; prices and number of listings shift by months and by quarter.

I’m a tech and AI entrepreneur who loves building smart tools and products. I start new businesses that use technology like AI to solve real-world problems. I enjoy turning problems into solutions with the help of AI and SEO that help people and make life easier.