Starting college is thrilling—freedom, friends, and a fresh start. But let’s be real, college also brings new financial responsibilities. Most students don’t realize managing money isn’t optional—it’s a life skill.

When I was in 12th, I blew half my budget in the first month on takeout, coffee shops, and an unnecessary pair of shoes. I didn’t even notice until I got hit with an overdraft fee. That mess-up taught me fast: if you don’t track your spending habits, your wallet will feel it—and hard.

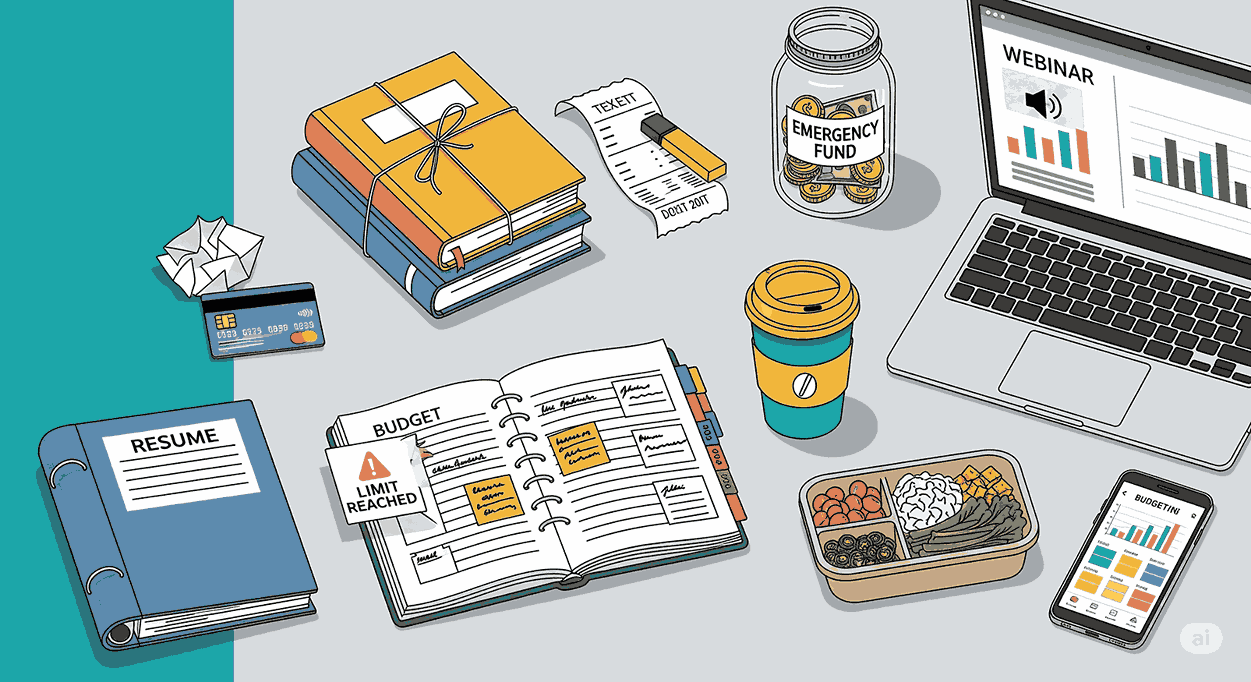

1. Know Where Your Money Goes: Track Every Dollar

Before you can manage your money, you need to know where it’s going. I once found out I was spending $200 a month just on lattes, snacks, and quick purchases.

Use an app, spreadsheet, or budgeting template. Tag each expense by category: rent, board, books, food, entertainment, and others like laundry, cell phone, or school supplies.

Check receipts, keep a money inventory, and review it weekly. Once you know where your cash is going, you can stop the leaks.

2. Create a Realistic College Budget You’ll Actually Stick To

Trying to live on a too-tight budget is a setup for failure. Be honest about your monthly income: job, allowance, scholarships, FAFSA, grants, or student loan disbursements.

List your fixed costs first: tuition, rent, meal plan, internet, laundry, and prescriptions. Then estimate variable expenses like eating out, entertainment, and supplies. Use the 50/30/20 budgeting method: 50% for needs, 30% for wants, 20% to save or pay debt.

Adjust when needed. I revised mine every spring semester, especially before spring break and finals when my spending spiked.

3. Separate Needs from Wants: Stop Impulse Spending

The hardest part? Saying no to temptation. That smell of pizza after class, those new sneakers, or one-click purchasing on Amazon.

Ask yourself: “Is this a need or a want?” I use the walk away rule—if I still want it after two days, I evaluate if it fits my budget. Nine times out of ten, I skip it. That impulse? Gone.

Curb frivolous spending by avoiding bored browses on shopping apps or late-night takeout. Peer pressure in college is real—but so is your long-term financial health.

4. Use Student Discounts and Freebies to Save Every Day

Don’t pay full price. Ever. Seriously.

Student discounts are a goldmine: restaurants, movies, public transit, stores, and even streaming services offer reduced cost or free options with your ID. My favorite tip? Always ask—many places don’t advertise the discount.

Sign up for Amazon Prime Student, get tech gear from the campus bookstore at a lower price, and grab used books or e-textbooks instead of full-priced ones.

Join clubs, attend events, and scope out free food at info sessions or study group meetups. You’re already paying for school, so leverage every resource it provides.

5. Cut Costs on Food, Textbooks, and Dorm Life the Smart Way

Meal plans eat up massive chunks of your budget. Choose the tier that fits your eating habits, not one that sounds fancy. Trust me, I wasted money on an expensive plan I never used.

Groceries are cheaper than eating at restaurants. Cook simple recipes, share costs with roommates, and skip those nonstop takeout orders. Grocery shopping in bulk and prepping meals on Sunday changed everything for me.

As for textbooks? Rent them, buy used, or grab the digital version. Many institutions even offer library reserves with the edition you need.

6. Learn the Basics of Banking: Checking, Saving, and Fees

Open a student checking account with zero fees, no minimum balance, and ATM reimbursement. Look for features like online banking, balance alerts, and mobile deposit.

Next, set up a savings account—preferably a high yield one. Even if you start small, your funds will grow thanks to interest rates.

Get direct deposit set up for your job or financial aid. This helps you access cash faster and reduces the urge to spend. I always keep cash reserves for emergencies, too. It kept me afloat when I needed a last-minute bus ticket home.

7. Use Credit Wisely: Don’t Let Debt Start in School

A credit card is a tool—not a piggy bank.

Use one with rewards or points only if you can pay the full balance each month. Missed payments = high interest charges, tanked credit score, and future loan pain.

Avoid relying on it for takeout, gaming, or online shopping. Keep it for emergencies or big purchases you’ve planned. I once didn’t read the fine print and got hit with a 24% interest rate for a new tablet. Never again.

Track balances, automate minimum payments, and treat debt like fire—controlled, or it’ll burn you.

8. Build a Savings Habit — Even If It’s Just $10 a Week

When I first heard “pay yourself first,” it clicked. Every time I deposited money, I moved a little—like $10—straight into my savings account. That habit built my emergency fund.

Use savings goals—like for a trip, semester books, or surprise expenses. A monthly savings plan makes it doable. Even small deposits add up over time.

It’s about discipline, not the amount. That emergency lunch during finals week? It was paid from my stash—not from swiping my credit card in desperation.

9. Look for Easy Ways to Make Extra Money On or Off Campus

Side gigs helped pay my bills when student loans weren’t enough.

Try babysitting, tutoring, pet care, or becoming a dorm RA for housing credit. Sell your notes, join research studies, or freelance online. I posted my music playlist reviews and made small cash on the side.

Join work-study or find part-time work aligned with your school schedule. Even a few hours each week can cover your laundry, meals, or phone bill.

Employment opportunities are everywhere—you just have to look, apply, and be consistent.

10. Get Financial Help When You Need It (Without Shame)

If you’re facing financial stress, you’re not alone. Tons of resources exist.

Ask your institution for financial aid, payment plans, extensions, or emergency funds. Fill out FAFSA yearly—it’s your ticket to federal loans, direct loans, grants, and more. Only borrow what you absolutely need and review the repayment plan.

I once didn’t apply for an emergency housing grant thinking I wouldn’t get approved. Turns out, many students miss out just because they don’t ask.

Whether it’s from parents, guardians, or a financial education workshop, support is there. Get ahead, not behind.

College Money Tips You Can Start Today

- Track your spending

- Use a realistic budget and update it regularly

- Avoid impulse buys—separate needs vs. wants

- Use student discounts and always ask for deals

- Cook more, rent textbooks, and skip premium meal plans

- Choose no-fee checking accounts and build savings

- Use credit cards with caution

- Save consistently, even small amounts

- Explore side hustles and part-time work

- Ask for help before panic sets in

Final Thoughts: Your Future Self Will Thank You

Start small and stay consistent. Managing money in college isn’t about perfection—it’s about avoiding big mess-ups and building smart habits.

The freedom to live, study, and grow without drowning in debt? That’s financial success. You’ve got what it takes. Your future depends on what you do right now.

FAQs

How do students manage their money?

Students manage money by tracking spending, making a budget, cutting unnecessary costs, using student discounts, saving regularly, and avoiding high-interest debt.

What is the 50/30/20 rule for managing money?

The 50/30/20 rule splits income into 50% for needs, 30% for wants, and 20% for savings or debt repayment.

What is the best advice for college students?

Learn to budget early, spend less than you earn, save a little each month, and build healthy money habits to avoid debt.

What is the 7-day rule for money management?

The 7-day rule means waiting seven days before buying non-essential items to prevent impulse spending.

✅ Sources & Helpful Resources:

- Federal Student Aid – FAFSA®

- Consumer.gov – Managing Your Money

- SavingforCollege.com – Budgeting Tools

- NerdWallet – Best Student Checking Accounts

- UNiDAYS – Student Discounts Directory

I’m a tech and AI entrepreneur who loves building smart tools and products. I start new businesses that use technology like AI to solve real-world problems. I enjoy turning problems into solutions with the help of AI and SEO that help people and make life easier.